Consumer staples stocks have underperformed the broader market recently but the sector’s long-term credentials are compelling and, with valuations at historically cheap levels, this looks like an attractive entry point, according to global equity managers.

The MSCI World Consumer Staples sector has traded at an average premium of 15% to the MSCI World for the past two decades and 20% for the past 10 years. These are stable, high-quality businesses so they arguably justify a higher multiple, said Ian Mortimer, manager of Guinness Global Equity Income.

The sector outperformed during the bear market of 2022 and briefly got to a 30% premium but it has de-rated since then.

This year, it has fallen far behind the MSCI World due to technology’s dominance in the index and because investors have been rewarding growth, Mortimer explained.

Performance of consumer staples vs broader market over 20yrs

Source: FE Analytics, performance data in sterling terms

Today, the global consumer staples sector trades at less than a 5% premium to the broader market. “If you are a believer in reversion to the mean then you could see the upside potential of that premium going back to where it has been historically,” Mortimer said.

The $5.9bn Guinness Global Equity Income fund has been overweight staples since inception with a 15-20% average allocation due to these companies’ healthy dividends, high returns on capital, earnings growth and ability to outperform in falling markets. It currently holds 25% in staples versus 7% for its benchmark.

During the past couple of years, as inflation has increased, companies have passed on higher costs to their customers by raising prices. Now that input costs are coming down, companies are unlikely to reduce their prices in lockstep, so they have the potential to generate excess earnings.

“The margin picture has improved substantially year-over-year, and this expansion looks set to continue,” Mortimer explained.

Consumer staples companies usually grow their dividends in line with their earnings growth, so by 3-4% a year, but recently dividends have grown at about 5%, reflecting companies’ stronger earnings, he said.

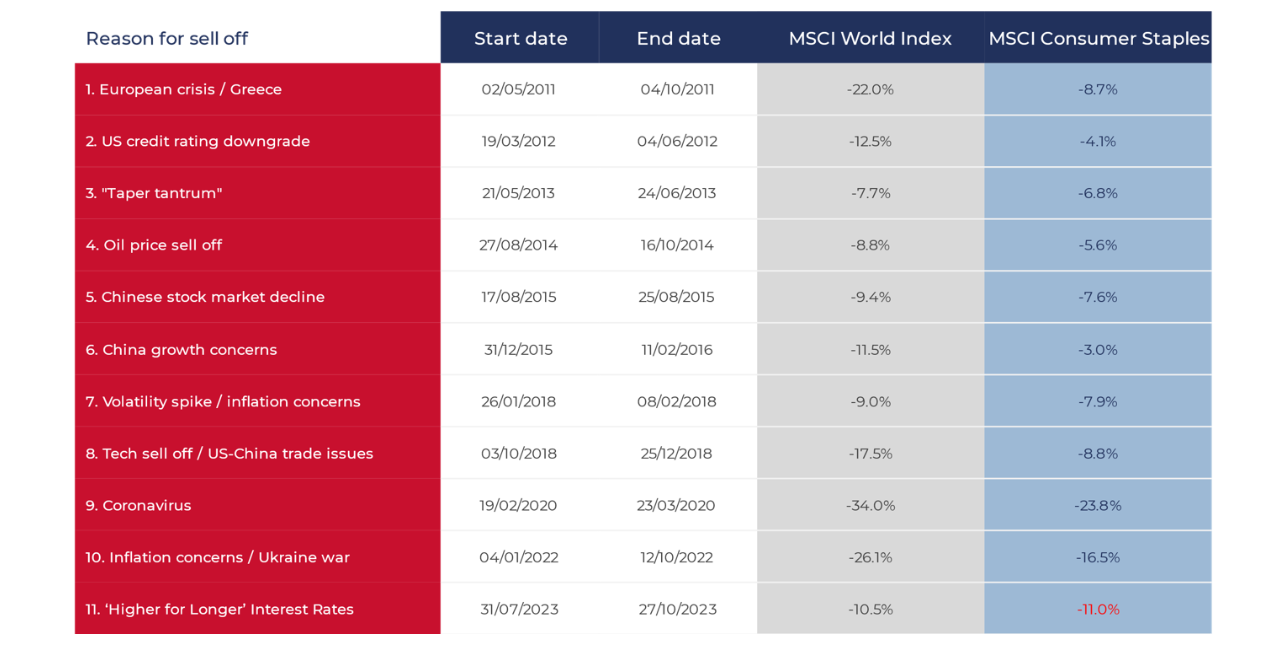

Mortimer also likes the downside protection that consumer staples companies provide. The sector has a relative downside capture of 78% and has outperformed in all but one of the past 11 significant drawdowns.

Consumer staples outperform in most downturns

Sources: Guinness Global Investors, Bloomberg, data in US dollar terms

Below, three global equity managers pick out a consumer staple they are banking on.

Lindt

The £448m Evenlode Global Equity fund initiated a new position in Lindt this year. The premium chocolate maker had been on Evenlode’s watch list for a long time but portfolio manager Chris Elliott said it has always been “reassuringly expensive”. However, the cocoa price has shot up during the past six months, weighing on Lindt’s share price, which provided Evenlode with a buying opportunity.

Lindt is well positioned because it has hedged its cocoa supply for the rest of this year and into next year. The company possesses significant reserves of cocoa and it is more dependent on South America for its production (whereas most cocoa suppliers source from Africa.)

Share price over 12 months in Swiss francs

Source: Google Finance

Colgate-Palmolive

Within the diverse consumer staples sector, household, toiletry and health product producers have the best sustainable growth prospects, according to Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund. “These are everyday need products with less economic risk,” he said.

Smit holds Colgate-Palmolive, whose portfolio of items that everybody needs generates “very stable and certain organic growth”. Its main brands have “a high loyalty factor”, he added.

The company’s Hills Pet Nutrition business provides “further profitable organic growth” and has the potential to expand its distribution, both in the US and elsewhere, he added.

Share price over 12 months in dollars

Source: Google Finance

Mondelez International

Guinness Global Equity Income – an equally-weighted portfolio – holds a variety of consumer staples, including Diageo, Nestlé, Procter & Gamble, Danone, Unilever, Reckitt Benckiser, The Coca-Cola Company and PepsiCo.

Cadbury owner Mondelez International is one of the cheapest, Mortimer said, due to the increase in cocoa prices and concerns over its input costs.

Share price over 12 months in dollars

Source: Google Finance

Mondelez has tried to increase its margins by cutting costs, removing layers of management and improving operating efficiency, with early indications that these efforts are bearing fruit, he said.